Is Real Estate Investment Trusts a Good Career Path?

These days, a lot of individuals are looking to forge their own career paths at their own pace without sacrificing potential income. Luckily, there are many growing industries in the world that allow you to be more independent without worrying about compensation. One of the most steady industries in the world is real estate, specifically real estate investment trusts or REITs, which makes it a good career path.

A REIT is a company that operates and finances income-producing real estate properties such as apartment buildings and commercial properties. REITs provide investors a platform to invest in real estate on a large scale with equally large income opportunities and without having to directly own or manage any property. There are two (2) kinds of REITs: equity and mortgage (also known as mREITS). Equity REITs cover specific properties that generate income from tenants, such as office buildings, retail centers, apartments, or hotels. Dividends, or the income generated and paid by these investments, are then distributed to shareholders. On the other hand, mortgage REITs invest in mortgages, mortgage-backed securities (MBS), and other real estate-related debt. mREITS take advantage of lending to acquire more assets and generate dividends. Hybrid REITs invest in both properties and mortgages.

Like with any other investment, REITs also come with their own risks, such as fluctuations in the interest rate, economic events that affect property value, and underperformance of real estate. Still, real estate is limited and the demand keeps on growing, thus the lucrative opportunities and career paths that one can pursue in this industry.

Table of Contents

What are the Best Jobs in REITS?

Property Manager

Property managers overlook the daily operations of the properties owned by the REIT. Also called Leasing Managers or Facilities Managers, the job calls for ensuring the satisfaction of both the REIT and the renters or users of the property.

Investment and Portfolio Manager

Portfolio managers are individuals that are in charge of the evaluation, acquisition, and management of the properties under the REIT’s portfolio. They scope out properties and present their evaluations to investors who will then decide if this will be a good investment or part of their portfolio. Acquisition analysts and portfolio managers need to be thorough in their evaluation, considering all trends and factors that go into acquiring a certain property in a specific location.

Marketing and Communications

Marketing is an essential arm of any business. For REITs, they are in charge of building and promoting the REIT’s brand to make sure that they reach out to their intended audience. Marketing goes hand in hand with Communications professionals, who represent the voice of the brand and reach out to potential investors, prepare statements for current investors, and in general communicate with all investors to assure them of their investments. Public relations (PR) specialists, social media coordinators, and marketing managers fall under this department in companies.

Finance Staff/Accountant

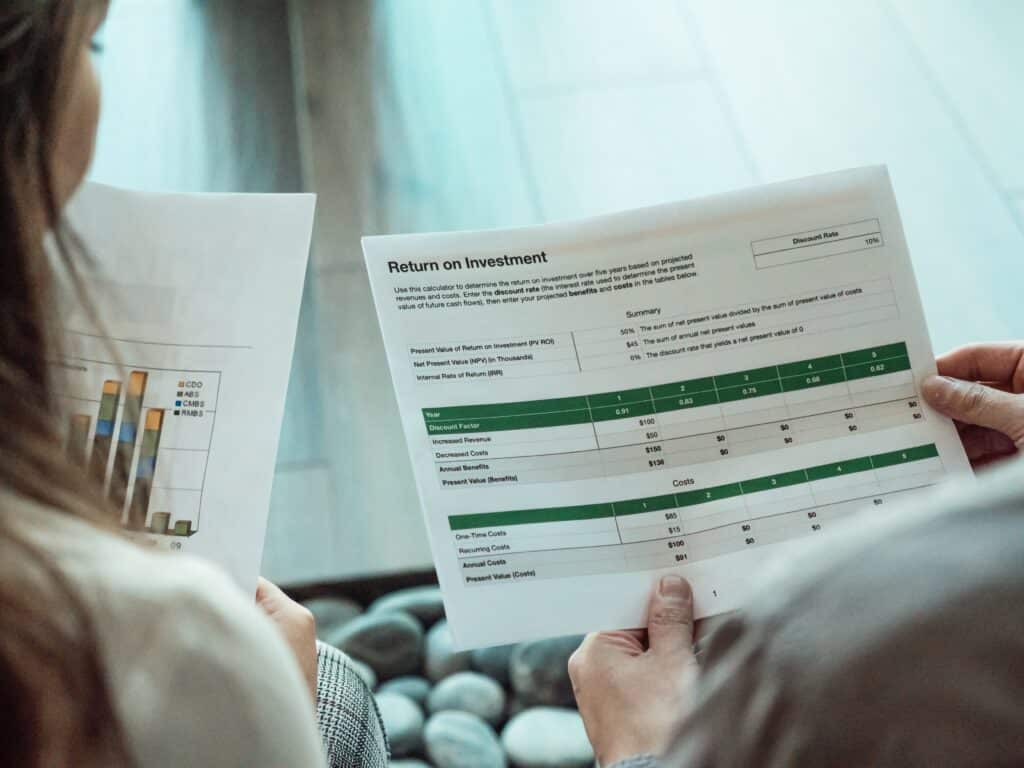

Keeping on top of finances is essential in REITs, or any other business and investments. Finance staff and accountants ensure the proper record keeping of all financial transactions, ensuring that the company complies with all state regulations and that all books are balanced.

Market and Data Analyst

Because real estate is directly affected by the movement of the economy, analysts are important to make sure the REIT keeps up with the industry and economic trends, so they can provide input on investment decisions and strategic planning. Analysts turn data into information that leaders can use as a solid basis for the next step for certain investments.

Legal and Compliance

Legal teams, which are composed of lawyers, legal assistants, paralegals, file clerks, and corporate counsel, are in charge of ensuring that the REIT is fully compliant with all applicable regulations and operates within the law. In case of any dispute, whether internal or external, these professionals lead the REIT in providing advice and the next steps in resolving any legal matter. While paralegals need an associate’s degree, lawyers need to devote significantly more time to at least four more years after their undergraduate. After this, they would also need to take the bar exam, which is taken individually per state, to be allowed to practice.

Why You Should Consider a Career in REITS?

In general, the real estate sector is seeing an upwards trend both in employment and hourly compensation. Depending on the job, location, and size of the company, the average salaries for various roles in REITs can range from $35,000 to $150,000 annually.

Opportunities and Compensation

Property managers generate an average income of $65,000 annually. In investment and portfolio management, the salary range starts at $55,000. It can go as high as $150,000 a year for portfolio managers. Acquisition analysts and asset managers can earn up to $90,000 and $120,000, respectively.

Professionals in real estate are required to have specific licenses, depending on the jurisdiction or the state. Licensing involves completing specific courses and passing a state-administered examination, which are renewed typically every three years. Property Managers or CPMs are certified by taking education courses and passing a certification exam on top of work experience.

Marketing specialist compensation in the REIT industry ranges from $35,000-$60,000 for social media specialists, $40,000-$75,000 for public relations professionals, and $50,000-$90,000 annually for marketing managers. With the growing demand for experience, especially in the use of technology in marketing, marketing and communications professionals can expect this to grow higher. While there are no specific requirements or state exams for marketing and communications professionals, many companies pay for courses or trainings that will upgrade their skills and make sure they are following the trends, especially in social media.

Finance and accounting professionals can also expect steady compensation opportunities with financial analysts and accountants earning up to $85,000 annually and CFOs raking up to $250,000, depending on the REIT’s size and portfolio. Analysts can also earn up to $85,000. This proves that talented professionals are in demand to ensure the upkeep of the REIT’s books and to provide proper analysis of incoming data for decision-making. While being a finance staff only requires a degree or certifications depending on the job requirements, being a certified public accountant (CPA) is an official title provided to an individual after a state exam. This does not only provide better compensation but also opportunities for higher-level positions. Meanwhile, financial analysts are certified by the Chartered Financial Analyst Institute.

In legal, specific specialties in real estate laws and investments are required by REITs to make sure that they will not be slapped with fines, suspensions, or worse, closures due to failure in compliance. Paralegals and compliance officers can earn up to $70,000 and $120,000, respectively. On the other hand, general counsels can earn as much as $250,000 annually. Lawyers have to renew their licenses annually, while file clerks and other staff also undergo training to hone their skills.

Outlook

As mentioned previously, the REIT industry is affected by many external factors, such as economic conditions, interest rates, demographic trends, and technological advancements. These factors are major movers in the outlook of the industry in the coming years, and those aiming to get careers in REIT should stay updated on the following:

- Economic Condition: One doesn’t have to look far when talking about the effects of the economy on real estate. The financial crisis of 2008 is a perfect example of how the REIT industry, or real estate in general, is closely tied to the economy. Growth in the economy usually leads to an increase in real estate demand and property values.

- Interest Rate: Low-interest rates make REITs more attractive, as borrowing costs decrease and make investing more profitable and accessible to potential investors. As with economic events and trends, higher interest rates lead to a decrease in both demand and lower property valuation.

- Demographic Trends: Demographics are huge influencers in the kind of real estate a certain location demands. Increased urbanization will call for more residential properties and office spaces.

- Technological Advancements: With the introduction of remote work in the workplace, real estate values have been affected; showing a drop in office properties but an increase in houses and rents. This shows that REITs must always be updated on trends that could possibly affect their portfolio and at the same time get ahead in investing in properties that will provide higher dividends in the future.

Good Foundation for a Good Career Path

The REIT industry is a good career path for those interested in real estate and investments. It has many aspects that provide good foundational knowledge that you can use in other industries or branches of the real estate industry. One must go through various licenses, exams, training, or even specific degrees to reach your target position in the future, but once you figure out what it is, knowing what’s to come will make the journey easier.

Sarah is an accomplished educator, researcher and author in the field of testing and assessment. She has worked with various educational institutions and organisations to develop innovative evaluation methods and enhance student learning. Sarah has published numerous articles and books on assessment and learning. Her passion for promoting equity and fairness in the education system fuels her commitment to sharing insights and best practices with educators and policymakers around the world.